VA loans offer low- and no-down-payment options for eligible veterans and other eligible borrowers.Be certain to ask your home mortgage consultant to help you compare the overall costs of all your home financing options. Our mortgage calculator’s payment breakdown can show you exactly where your estimated payment will go: principal and interest (P&I), homeowner’s insurance, property taxes, and private mortgage insurance (PMI). FHA loans have the benefit of a low down payment, but you'll want to consider all costs involved, including up-front and long-term mortgage insurance and all fees. A monthly mortgage payment is made up of many different costs.FHA loans are available with as little as 3.5% down.

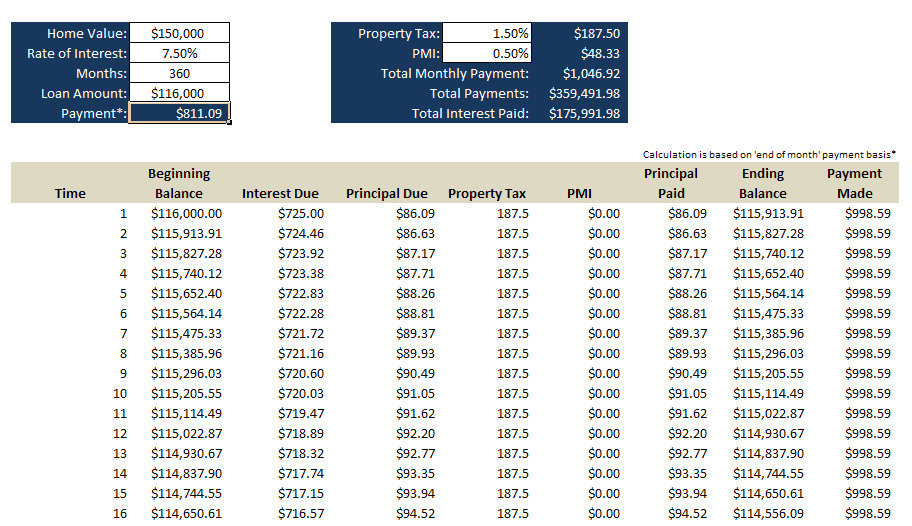

Keep in mind that with a low down payment mortgage insurance will be required, which increases the cost of the loan and will increase your monthly payment.Conventional fixed-rate loans are available with a down payment as low as 3%. Our mortgage calculator can help you determine your monthly payment, estimate a schedule, and see how much interest you might pay over the length of the.Monthly Payment the payment amount to be paid on this mortgage on a monthly basis toward principal & interest, taxes and insurance.Wells Fargo offers several low down payment options, including conventional loans (those not backed by a government agency). Insurance If your financial institution will be keeping an escrow account, billing you, and handling the payment of your property insurance then include that yearly amount here.

#PAYMENT MORTGAGE CALCULATOR FREE#

This payment frequency scenario would have you mortgage free the fastest Compare Mortgages.

Taxes If your financial institution will be keeping an escrow account, billing you, and handling the payment of your property taxes then include that yearly amount here. You could be mortgage free 3 years, 2 months sooner by switching to accelerated bi-weekly payments. Quickly see how much interest you could pay. Note that this is the interest rate you are being charged which is different and normally lower than the Annual Percentage Rate (APR). Use this mortgage calculator to determine your monthly payment and generate an estimated amortization schedule. Mortgage Amount the original principal amount of your mortgage when calculating a new mortgage or the current principal owed when calculating a current mortgage Mortgage Term the original term of your mortgage or the time left when calculating a current mortgage Interest Rate the annual nominal interest rate or stated rate on the loan. Here are some additional ways to use our mortgage calculator: 1 Assess down payment scenarios Adjust your down payment size to see how much it affects your monthly payment. Mortgage calculator without taxes and insurance. By depositing your surplus funds and savings into the Home Credit account, you can reduce the tenure of your loan by 0 years 2 months. A mortgage payment calculator is a powerful real estate tool that can help you do more than just estimate your monthly payments.

This is a good estimate when keeping taxes and insurance in an escrow account the payment charged by your financial institution could be different.įor a simple calculation without insurance and taxes, use this When calculating a new mortgage where you know approximately your annual taxes and insurance, this calculator will show you the monthly breakdown and total. Calculate your total monthly mortgage payment.

0 kommentar(er)

0 kommentar(er)